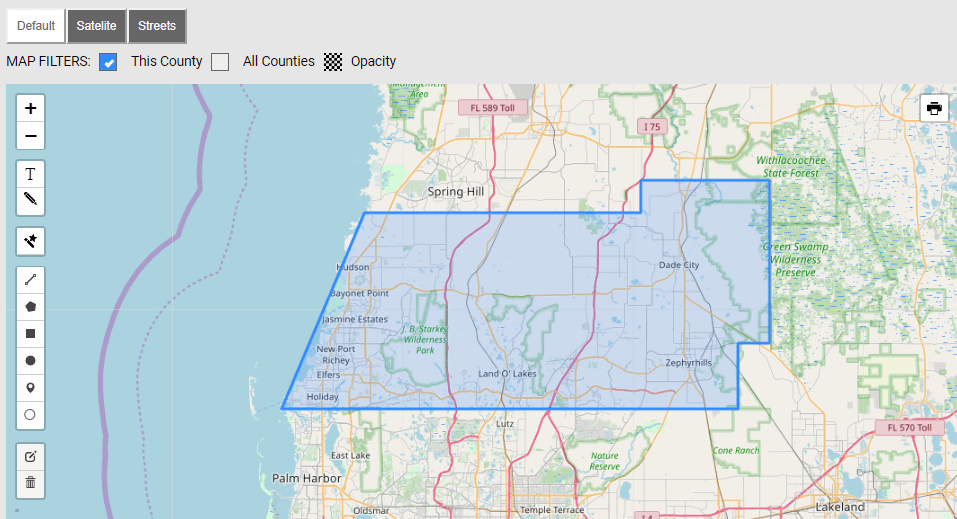

how are property taxes calculated in pasco county florida

As calculated a composite tax rate times the market value total will show the countys whole tax burden and include your share. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply.

Side By Side Property Tax Bills For Tampa Bay Neighbors Show Large Disparities

The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400.

. Thank you for visiting your Pasco County Property Appraiser online. During the month of October the Florida Breast Cancer Foundation will be the featured charitable giving organization at the Pasco County Tax Collectors Office. Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill.

SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Business Tax Receipt Information. Pasco County Florida Property Tax Law Find the right Property Tax attorney in Pasco County FL.

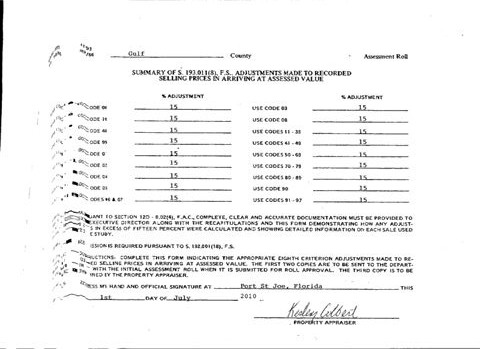

This is largely a budgetary exercise with entity managers first. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value Assessed Value - Exemptions Taxable Value Taxable Value x Millage Rate. How do I print my real estateproperty.

My team and I are committed to exceptional service fairness and accuracy. Search all services we offer. Our Pasco County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax. The basic formula is. Of the sixty-seven counties in Florida Pasco County is ranked 30th by median property taxes and 27th by median tax as percentage of home value.

Please visit our records search page locate your property then click on the Estimate Taxes link at the top. While Pasco County collects a median of. The operating property tax rate for the upcoming fiscal year would stay at 76 mills or 760 in property tax for each 1000 in appraised taxable property value the same as in the.

Pasco County collects on average 087 of a propertys assessed fair. This simple equation illustrates how to calculate your property taxes. Electronic Property Tax Notice Receipts.

These are deducted from the assessed value to give the propertys taxable. Calculate Taxes To calculate your taxes we first need to locate your property. The Florida Breast Cancer.

Change My Property Tax Mailing Address. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Explaining The Complexities Of Property Tax Calculations Route Fifty

Faqs Pasco County Property Appraiser

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Florida Dept Of Revenue Property Tax Data Portal

Pulte Homes Morris Homes For Sale In Land O Lakes Pasco County Fl

Home Pasco County Property Appraiser

5014 Avalon Park Boulevard Wesley Chapel Fl 33545 Point2

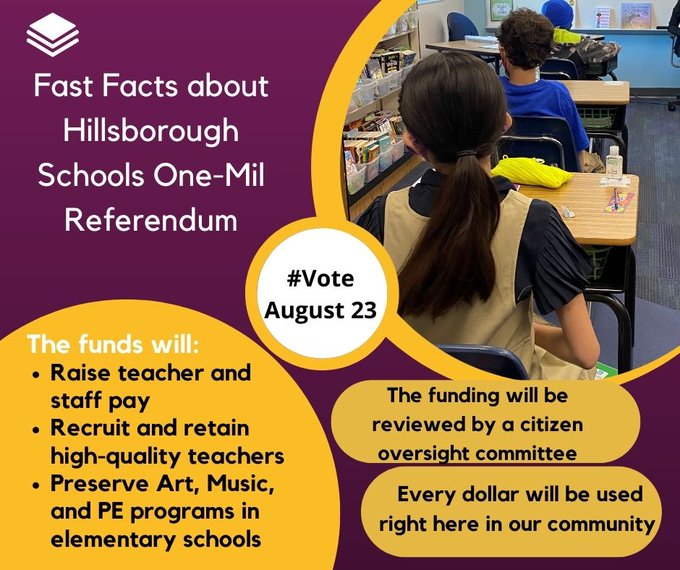

Aug 23 Voter Guide Property Tax Increase For Duval Schools Jacksonville Today

Faqs Pasco County Property Appraiser

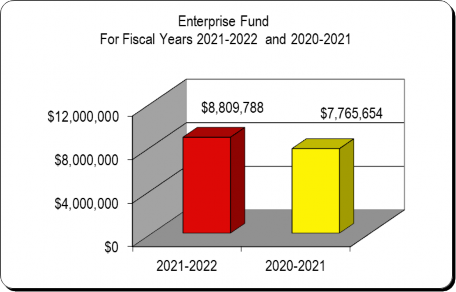

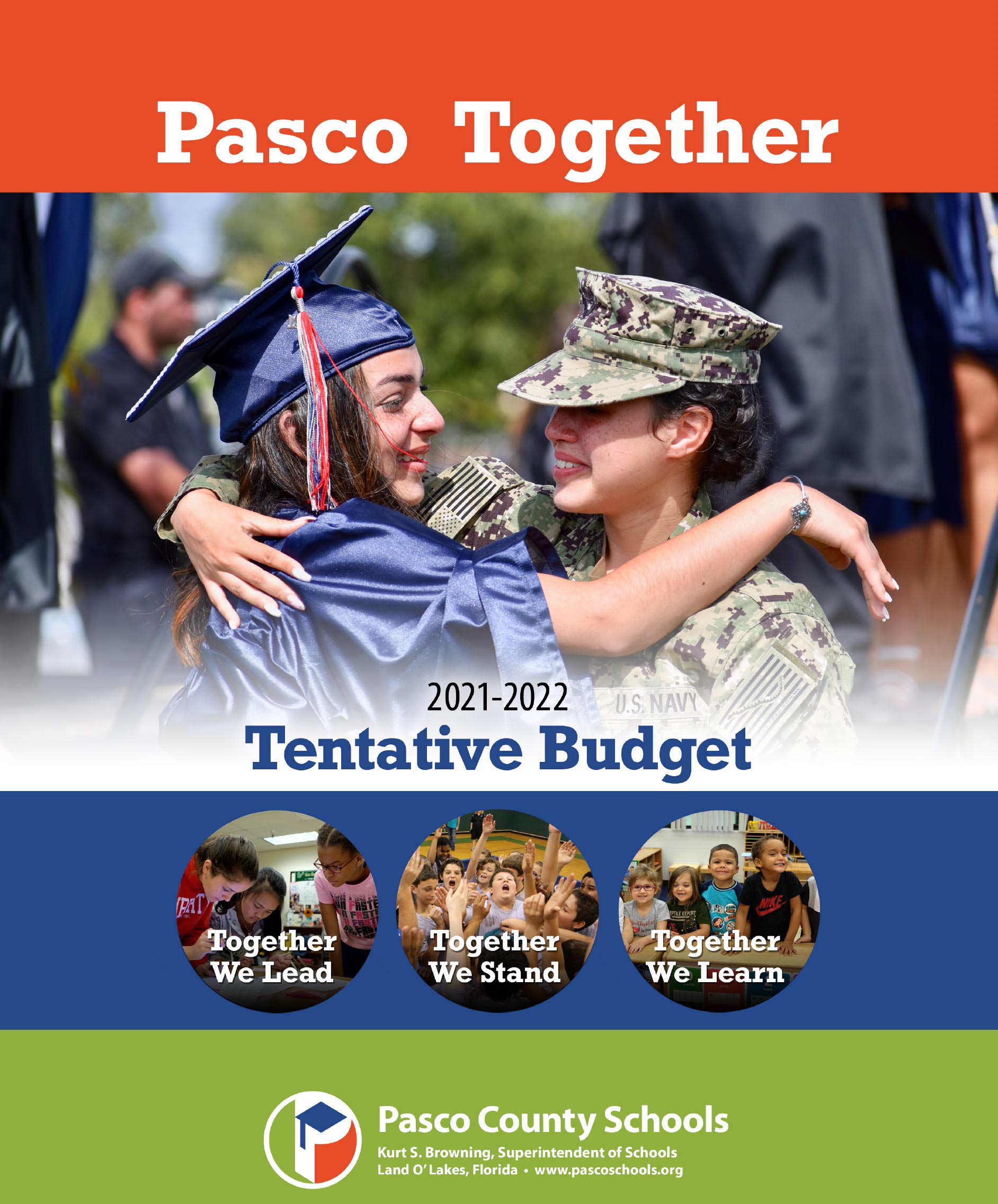

2021 2022 Tentative Budget Book

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

How To Calculate Property Taxes Real Estate Scorecard

Florida Dept Of Revenue Property Tax Data Portal

Florida Property Tax Calculator Smartasset

Pasco Commissioners Keep Property Tax Rates The Same So Expect A Bigger Bill